forty four cash now would not offer loans and we would not have any say within the costs or phrases of our lenders. Our expert services are meant to take your data then make it simple to discover the lender that can ideal provide your needs.

Frequently, a person carrying on company or career maintains publications of accounts and prepares a equilibrium sheet and also a financial gain or reduction account to grasp the economic place of his business or occupation for your money year.

EXPAND your request to incorporate supplemental economic choices that specialise in consolidating unsecured debt.

Rapid Loan Direct highlights the significance of an crisis fund and fast fiscal alternatives for fast demands.

Beneath the earnings tax regulations, somebody engaged in prescribed company or career is needed to mandatorily maintain books of account, prepare fiscal statements and get his accounts audited. Further more, income/decline According to such economic statements might be viewed as to arrive at taxable profits after making vital adjustments.

Our on-line forms are easy to complete with the consolation of your own property and might be done in minutes.

No other deductions for business expenses that are usually allowed can be claimed eg. depreciation, hire, administrative expenditures etcetera

We require your bank account data to validate your id and allow lenders to deposit funds into your account When your financial loan request is authorized. Accurately offering your financial institution info ensures that any transactions are directed to the proper account and improves security against fraudulent activities.

Use this funds calculator so as to add up the whole amount of money for prevalent denominations of expenses, cash and rolled or bagged coins in these currencies:

In case of Part 44AE, click here if taxpayer can be a partnership firm, income and interest paid out to companions is allowed as deduction from prescribed money previously mentioned

Be sure to critique the regulations inside your point out to learn more regarding the implications of not repaying a payday loan.

Total progress tax might be paid out by last installment of progress tax i.e., 15 March of a yr, in case of failure to do so, curiosity is leviable @ one% on shortfall According to Part 234C

six% of overall turnover or gross receipts of the tax year received by account payee cheque/lender draft, ECS by checking account on or before due date of submitting the return of revenue

Our forex converter will provide you with the current EUR to USD fee And the way it’s modified in the last day, week or thirty day period.

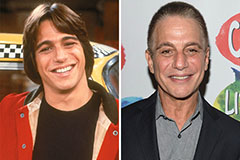

Tony Danza Then & Now!

Tony Danza Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!